Fast delivery

Fast delivery

Our Specialized team works efficiently to get your orders to you as quickly as possible

24/7 support

24/7 support

You can contact any of our agents for any questions yo may have

Track record

Track record

With over 15 years in the market,our company has a proven track record of delivering reliable and high-quality services.

Comprehensive Document Solution

Comprehensive Document Solution

Whether you’re looking for compliance documents or other essential paperwork, we provide a comprehensive solution that grows with your business, ensuring you have the necessary tools to operate legally and efficiently

What is a certificate of Good Standing?

A certificate of Good Standing certifies that a company is properly registered with the state, is up to date on all state registration fees and required document filings, and is legally permitted to engage in business activities in the state. In some states, it is called a certificate of status or certificate of existence.

A certificate of good standing typically has an expiration date, which is usually when the registration is due to be renewed, or when periodic documents or registration fees are due. This could be at the end of a calendar year, or at some other time during the year when the state’s laws require renewal or periodic filings.

What is a Sellers Permit?

A seller’s permit, also known as a sales tax permit or sales tax license, is a state-issued authorization that allows a business to sell products and services at retail and collect sales tax from customers. The permit is essential for businesses that operate in states where sales tax is levied on transactions.

Your business can legally collect sales tax on taxable sales. This is important for maintaining accurate tax records and avoiding penalties or fines for non-compliance.

A Seller’s Permit allows you to purchase goods at wholesale prices without paying sales tax at the point of purchase. This can reduce your costs and improve your profit margins

File an Annual Report for your Company with Files Request

Filing an Annual Report Is Required by Your Secretary of State — For All Business Entities.

Lighten your workload and ensure your business stays compliant by letting Files Request handle your annual report filing.

Federal Employer Identification Number (EIN) / Tax ID Number

The SS4 is the IRS form required to obtain an EIN (Employer Identification Number, frequently called a Tax ID number). The EIN/Tax ID number can be thought of as a Social Security Number for your business. It is usually required to open a bank account in the name of the business and to properly pay and account for any wage/payroll employees of your company. Files Request will obtain your federal EIN electronically and have it back to you via email within one business day.

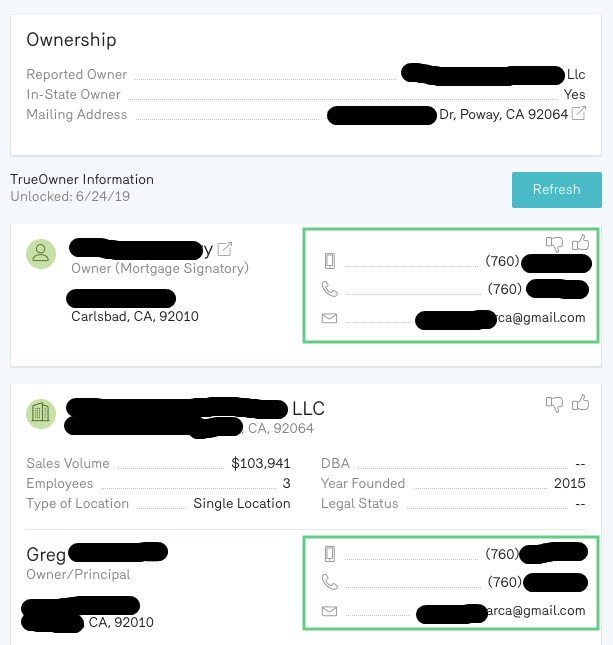

What is a Property Owner Lookup?

A property owner lookup is a service that allows you to identify and obtain detailed information about the owner of a particular property. This can include the owner’s name, contact details, property tax records, and other relevant information. Whether you are a potential buyer, real estate professional, or someone interested in a specific property, a property owner lookup provides essential insights that can assist in your decision-making process.

We offer a thorough property owner lookup service that provides detailed information on property ownership, including the current owner’s name, address, and property tax details. Our comprehensive search covers a wide range of data to give you a complete picture